The Next Generation Standard for UK Retail Payments: 2021 Update

Wouldn’t it be great to receive a bank statement where every item was clear on what it was and where it came from?

Wouldn’t it be great when you send a housing payment to know exactly where it is in the chain?

Wouldn’t it be great if tax payments and administration could become more automated, saving businesses and individuals huge amounts of time and manual effort?

Wouldn’t it be great if we could send additional specific information in a payment that could be used quickly by anti-fraud specialists across different organisations to identify suspect payments?

The migration of the payments industry to the ISO 20022 standard, not just within the UK but globally, will have a profound impact on the data carrying capability of payment systems. Whilst the fundamentals of a robust and resilient clearing and settlement mechanism will remain, the ISO 20022 standard will take the exchange of data to new heights; richer information through an increased quality and quantity of data, will lead to improved benefits for the entire payments’ ecosystem and beyond; from direct participants (e.g. banks) to end users (e.g. businesses).

At the end of last year, the Standards Authority within Pay.UK published the conclusions to its earlier consultation “The Next Generation Standard for UK Retail Payments”. We had received a substantial number of responses from a wide range of entities and individuals – from participants to solution providers to end users – all with a strong interest in the migration to ISO 20022 and the benefits it will provide. We received strong industry support for our direction as a standards setting body, our role in the ecosystem, our partnership with the Bank of England as operator of CHAPS and RTGS (“the Bank”), and an overarching commitment to work with us as we move forward.

In our publication, we stated our intention to keep industry informed of our progress against what we outlined we would do; this periodic update serves to provide these key developments. We will then aim to publish a further update in 2022.

For those who will be implementing ISO 20022 for their institutions…

Clarity on our standards technical collateral and design approach.

We continue to engage closely with those who will be implementing and ensuring readiness for the ISO 20022 standard. These stakeholders told us that clarity over when we would publish our technical standards artefacts was paramount for them, so that they could consider and plan for implementation appropriately. This year, through consultation with our respective external advisory bodies, the Industry Standards Coordination Committee (ISCC) and its sub-group, the Community of Developers (CoD), as well as through our various NPA fora, we set out our design approach and published our first set of technical standards materials. This first Collection focused primarily on use cases for Single & Multiple, Priority & Same Day payments. Our engagement with industry stakeholders remains a key cornerstone in how we develop standards and we look forward to sharing our second collection of technical collateral in the coming weeks. As noted previously, should you be interested in joining CoD, please do not hesitate to contact us.

Continued alignment with the Bank of England.

Interoperability with CHAPS payment messages continues to be a primary focus for us and a key requirement for implementers of ISO 20022 between the retail and high value payment infrastructures. Our objective remains that we develop our standards technical collateral as closely aligned with the Bank as possible to ensure that, where appropriate, the “look and feel” of technical collateral between the respective infrastructures is similar. Consequently, we issued a joint statement this year updating industry on how this partnership is growing and delivering.

We continue working with the Bank towards supporting the use of structured data (including structured addresses) and the benefits this will bring. At the end of 2020, we jointly published a draft list of Purpose Codes that could be used for both the NPA and CHAPS. We received significant engagement on this via the consultation portal itself, the Standards Advisory Panel (SAP) and the ISCC, and through bilateral conversations with participants. Many of these responses focused around the challenges of implementing a sizeable list of purpose codes, which ones would be mandated and how the purpose code data could be validated – all extremely valuable comments which we will continue to work through with industry to understand and develop further. We published the final recommended set of Purpose Codes with the Bank at the start of October and will continue to show-case this joint work with the Bank through webinars and industry fora. The full list of Purpose Codes remain as per the international definitions.

Timelines required for implementation.

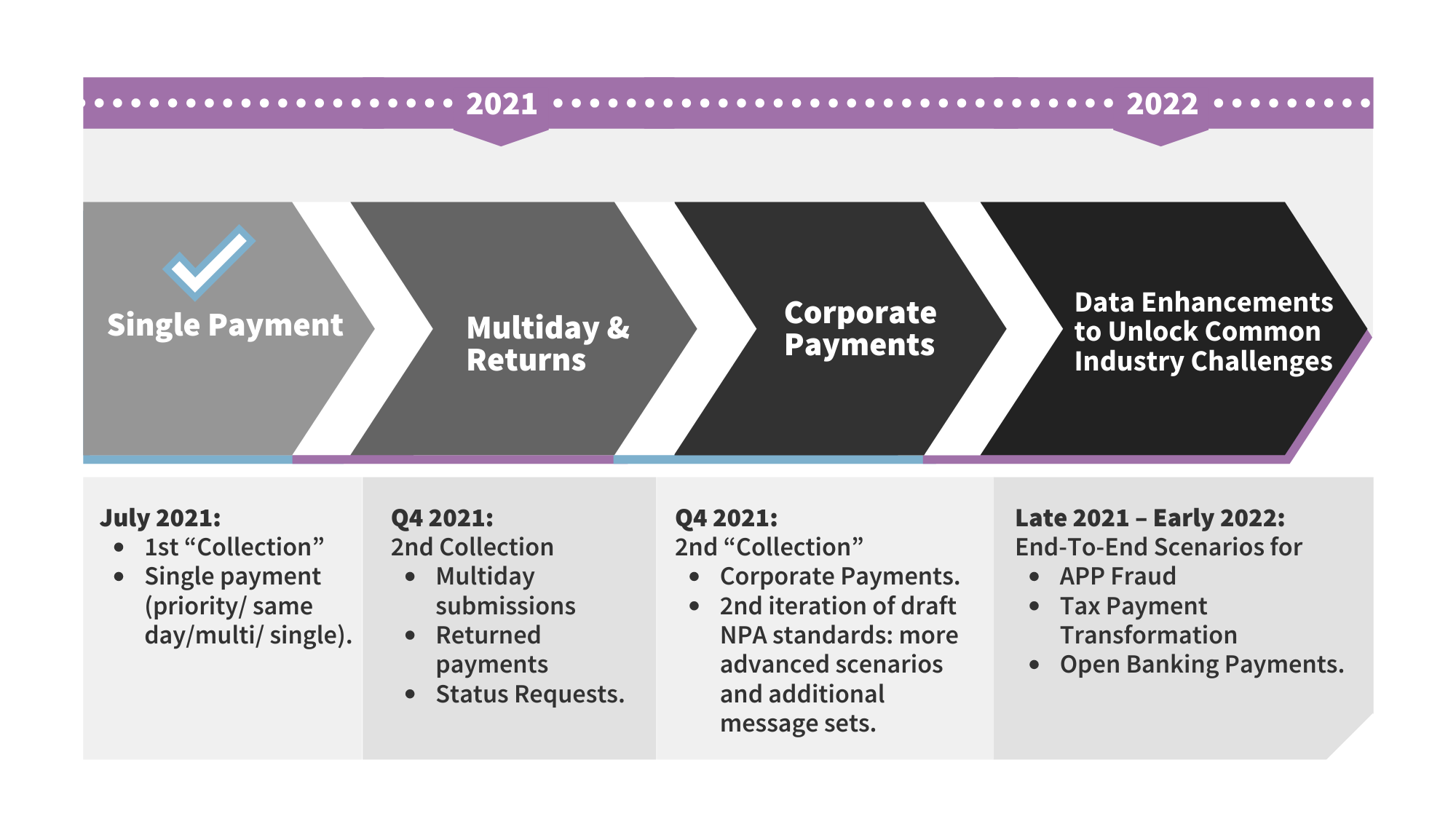

Alongside continuing and developing conversations with stakeholders, Pay.UK has been working hard to set out a clear route and structure for what our stakeholders can expect throughout 2021 and 2022. We have listened and understood that a clear articulation of timelines associated with our standards technical collateral, will give developers and their respective organisations the ability to plan effectively through their annual investment cycles. These revised indicative timelines were published as part of the release of our standards technical collateral in July, but are refined below. We will work closely with stakeholders to ensure the appropriate considerations continue to be incorporated. Please note that these may still be subject to change.

For those who will be innovating and providing solutions to their clients…

Developing examples and the approach to Remittance Data.

The responses to our consultation evidenced strong support for the inclusion of enhanced remittance data within the standard. Many respondents recognise the potential benefits that including this information in a payment message could bring. This year, our Director of Standards, James Whittle, became the Chair of the Payments sub-group at the Business Application Software Developers Association (BASDA). This newly formed group at BASDA will allow us to understand first-hand the challenges solution providers might face with enabling remittance data for their clients. This will ensure we develop an approach to including this information in a payment message collaboratively with industry. The group will complement the Remittance Data Taskforce we plan on issuing a Call for Interest on, working with organisations such as Oracle to understand the specific end-to-end remittance data use cases that industry will want to work on together.

Collaborating on Whitepapers & Proofs of Concept with other industry bodies.

Since our publication last year, we have received a number of requests by interested parties to develop “whitepapers” and Proofs of Concept. Each of these seeks to raise awareness of specific challenges associated with the migration to ISO 20022 or develop particular examples that will help to bring to life the benefits of the NPA standard through industry collaboration:

- Whitepapers

Our recent whitepapers with Volante and Baringa articulated the key challenges that institutions needed to consider as part of the transition to ISO 20022 and how having a smart modernisation approach was necessary. This was supplemented by a well-attended public webinar Chaired by our Director of Standards with panellists from Barclays and Sky Scanner sharing their own experiences and insight into these challenges.

- Mitigating APP Fraud and Enhancing Tax Payments

We are collaborating with Open Banking, HMRC and the Bank to develop a new, enriched data standard that solves challenges associated with UK tax administration; assisting a multitude of businesses who have to make regular PAYE tax payments. The goal is to reduce the significant friction, oversight and operational risk currently existing, by standardising the data so it can be sent and received easily by businesses and HMRC.

Last year, £479 million was reportedly lost to APP fraud in the UK. As such, we have been working closely with UK Finance, its members and the Bank to develop a standard data model that could be used to help address this industry-wide problem. The initial phase has already determined several key pieces of information that could be standardised and exchanged across organisations to help identify suspect payments earlier in the process. If successful, the aim is to develop a standardised data model that would be built on the initial dataset and be extensible for further in-depth data analytics and more broadly beyond APP.

Such examples demonstrate a clear enthusiasm by industry to raise awareness of the challenges and the ultimate benefits that migration to ISO 20022 will enable through its enhanced data offering.

Ensuring appropriate interoperability

Interoperability with the Bank continues to be a primary focus for us and remains a key requirement for industry stakeholders between the retail and high value payment infrastructures. Our objective remains that we develop our standards technical collateral as closely aligned with the Bank as possible to ensure, where appropriate, the “look and feel” between the infrastructures is similar. We continue to invest in dedicated resource to help support this partnership and ensure that our approaches, collaboration and communications are aligned. Consequently, we issued a joint statement this year updating industry on how this is partnership is growing and delivering.

For those who are businesses, charities and other end users…

Using standards to help mitigate Authorised Push Payment (APP) Fraud

From the conversations we have had with end users, the ability to mitigate APP fraud, remains one of their top priorities. In its 2021 Confirmation of Payee consultation, the Payment Systems Regulator noted that “in 2020 alone, APP scam losses totalled £479 million, with the actual figure including unreported losses likely to be much higher”. The concerns around fraud have been echoed by attendees on our external fora and through bilateral conversations we have had. Ahead of the NPA, and with a consideration of what could be done in the current services, we are working closely with UK Finance and some of its members (specifically economic crime specialists) to understand what data could be exchanged between participants to help mitigate APP, and develop a clear strategy for how this data could be trusted and used.

The initial phase has already determined several key pieces of information that could be standardised and exchanged across organisations to help identify suspect payments earlier in the process. If successful, the aim is to develop a standardised data model that would be built on the initial dataset and be extensible for further in-depth data analytics and more broadly than for just APP.

Facilitating and streamlining tax administration for HMRC and tax payers

For many businesses and self-employed individuals, tax administration can be a highly manual and time-consuming process. SMEs in the UK employ 16.3 million people, or 60% of the UK’s private sector workers – this is an important issue for UK competitiveness.

To support and enhance the methods by which UK tax payments and data are collected, we are collaborating with HMRC, Open Banking and the Bank to develop a Proof of Concept that will seek to enhance the way businesses make regular PAYE tax payments. The goal is to reduce the significant friction, oversight and operational risk currently existing, by standardising the data so it can be sent and received easily by businesses and HMRC. The authority of HMRC to influence the adoption of payment and data standards is considered a key enabler of end-to-end payments transformation aligned to Pay.UK’s strategy.

Developing our approach to the Building Blocks within the Standard

There was strong support for our approach to implementing the ISO 20022 standard, in particular how the Building Blocks – Legal Entity Identifiers (LEIs), Structured Data, Purpose Codes, Enhanced Characters, Enhanced Remittance Data, and the Unique End-to-End Transaction Reference (UETR) – would be applied in practice. We remain mindful of the priority areas of focus for end users, namely “certainty of payment” and the ability to send extra information as part of a payment. The UETR will embedded from Day 1 of the NPA so that users will know exactly where their payment is – something we have previously referred to as the “FedEx” of payments. The other Building Blocks, particularly Enhanced Remittance Data and Characters, and Purpose Codes, will allow additional data to be sent as part of a payment, providing further clarity and information about a payment for a receiver. Again, these will be available as optional fields when the NPA goes live, with scope to explore opportunities with stakeholder groups around when it might be appropriate to mandate the use of certain fields in special circumstances (e.g. housing payments).

We are continuing to unpack with our industry stakeholders what aspects will need to be fulfilled in order to realise the benefits that the Building Blocks will unlock for businesses and other end users. For example, establishing how the data being carried can be trusted and verifiable.